Q&A with Dr. Terry Huang

Dr. Terry Huang is the vice president and head of the Asia-Pacific Region at Motif Art Group. Previously, he was the panel advisor of the National Endowment for the Arts (NEA) and a professor at New York University. Dr. Huang got a PhD in the history of Modern Art at Harvard University, and an MS in arts administration at Boston University. He has published many books, including Philip Guston: Night Studio, His Art in Woodstock, and the Semiology of Visual Languages in Contemporary Art.

Q: What do you think are the driving forces behind the shift toward viewing art as an asset in recent years?

A: The comparatively poor performance of traditional asset classes, such as real estate, commodity futures, private equity, and hedge funds, in recent years has driven the search for greater returns via alternative asset classes.

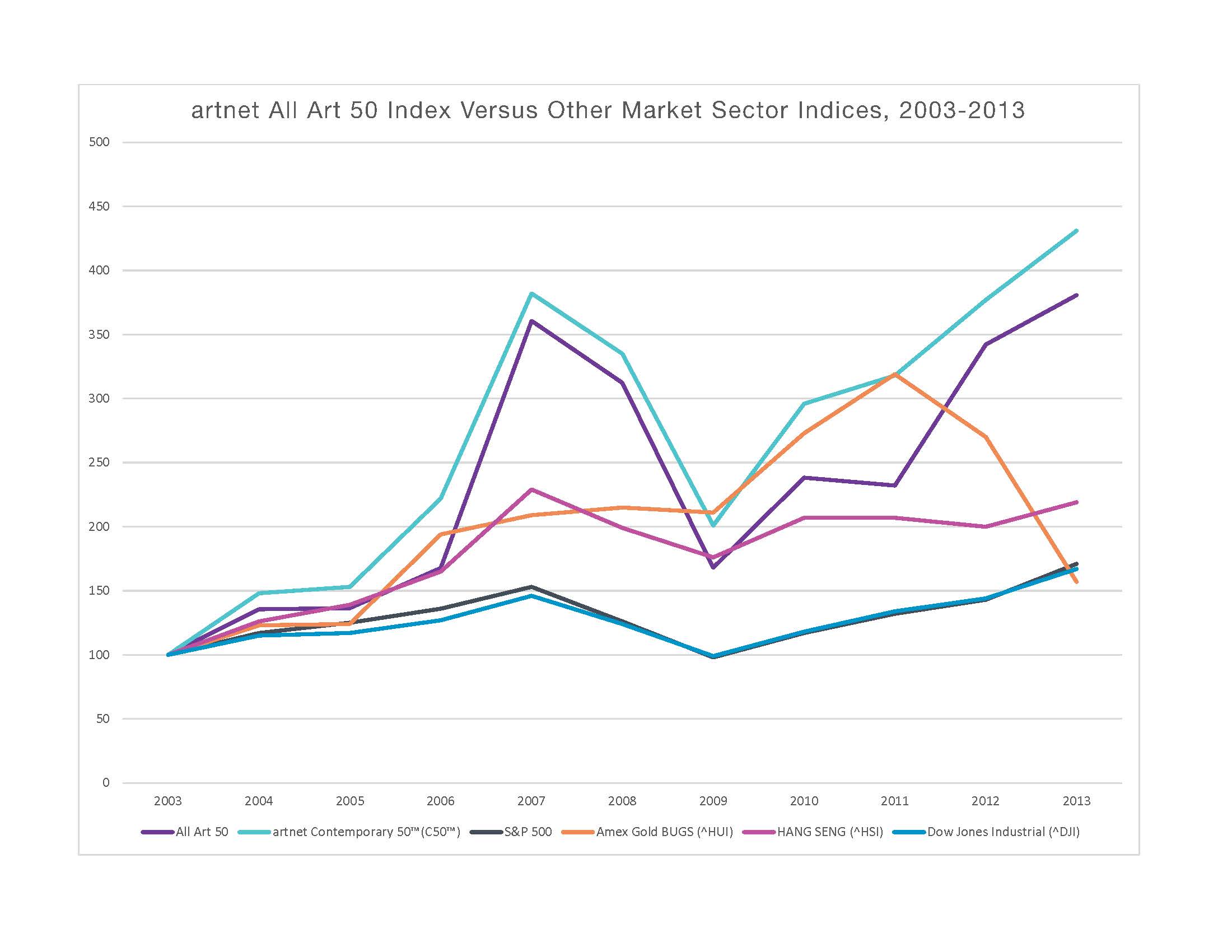

According to the artnet Analytics, the art market, in comparison to traditional asset classes, has been fast expanding following the financial crisis in 2009, and this expansion has, in turn, created a desire to view art from a financial point of view. Despite its opacity, volatility, and lack of official regulations, over the long term, more and more investors believe that art is a sound investment that can yield relatively higher returns compared to traditional asset classes.

Moreover, investors have learned the importance of asset allocation, seeking alternative assets to diversify their investment portfolios and reap higher returns while minimizing risks. Art can also offer a low, and even negative, correlation with equities, bonds, and real estate, which also makes it an option for asset allocation.

Q: How would you describe the size of the market for art-related financial services as compared to traditional financial services, and what do you envision its future potential to be?

A: According to a survey conducted by Deloitte in their Art & Finance Report 2013, among private banks, art professionals, and collectors, it is reported that although the primary reason for buying art is its emotional and social value, financial motivations are no doubt becoming increasingly important among sophisticated collectors.Financial institutions have made advances in assessing the value and risks attached to art, introducing new types of collective investment vehicles, such as shared transactions, art funds, and art loans. Art funds are said to be the most successful, and have gained the highest market acceptance, both in Western countries and in China.

2011 was by far the most prosperous year for art funds, where both the quantity and scale of art funds significantly increased. In China, the total scale of art funds in 2011 reached US$320 million, of which, US$300 million was raised during the second half of 2011 and the first quarter of 2012. At that time, there were 44 art funds issued globally, 21 of which were issued in China.

However, by 2012, the number of art funds began to decline. In the first quarter of 2012, there were only 13 art funds issued in China, four in the second quarter, and three in the third quarter. This decreasing figure demonstrates not only the frustrated art market, but also the dejected art fund market. On the other hand, even in the most prosperous period of art funding, the scale of art funds globally (US$320 million in 2011), only made up approximately 2.7% of the US$11.5 billion total auction revenue. This small percentage indicates that even art funds, the biggest and most popular art-related financial products, are still not big enough to influence, or have decisive power over, the art market, not to mention the minor capital scale as compared to the scale of global hedge fund assets, at around US$1.7 trillion in the same year. This also reminds us that art investment is only a small portion of the whole financial market, and that it should not be viewed the same way we view stocks and bonds.

Q: From an art fund perspective, what features does art share with other asset classes, and what features are unique to art? How do art funds/wealth managers handle these differences?

A: Art is so unique that it can hardly be regulated or perceived as other financial asset classes. The biggest difference between art and traditional asset classes is that a work of art is hard to authenticate, and hardly any standard for assessing and evaluating exists. Also, as works of art cannot be traded every day, liquidity is relatively low as compared to other financial assets, such as stocks and bonds, and, thus, no daily net asset value is available. Moreover, essential information, such as provenance, is not easy to access or verify, making the art market a market with asymmetrical information and a lack of transparency. Last but not least, owning a piece of art requires a huge amount of maintenance, including insurance and storage fees, which equal a 25% depreciation of the purchase price.

To assist investors in breaking through these entry barriers, and to reduce additional costs while enjoying the high return art may bring, art funds were created. There are different rules and restrictions on art-related financial products, such as art funds, which are based on a trustworthy management team to invest in art and generate profits for their investors. Processes, including the selection of artists and their works, the authenticity of the artworks, and controlling for a potential rise in value, all require a certain degree of professionalism in the art financial markets. Moreover, by way of funding, investors can share the additional costs, such as storage and insurance, with other investors, thus reducing the cost to a large degree.

Q: How is the idea of art and finance perceived in China? Are there any unique challenges or opportunities there?

A: With a huge amount of speculative capital entering the art market in China within such a short period of time, China has quickly become one of the most important countries in the art market as a whole. And the expansion of the art market has also encouraged Chinese collectors to view art as an investment, and as an investment vehicle. Financial products, such as shared transactions, art funds, and art loans, have all experienced ups and downs in the market.

However, the greatest challenge lies in the fact that collectors in China largely have no interest in appreciating art, and are only interested in investing. Chinese investors lack the aesthetic appreciation and operating experience required to become market players. This is why most art fund companies or professional art managers, who are supposed to serve as educators and fund operators, are not highly valued in the Chinese art market.

Moreover, the border between the primary and secondary art market has become less obvious. Many investors approach auction houses directly. Auction houses in China have been collaborating with galleries and artists for years. Some auction houses also team up with banks and other financial institutions, giving their customers (buyers) a direct channel to apply for loans for an artwork.

Q: Do you see any new trends in recent years?

A: Over the past 10 years, the Chinese art market has grown rapidly; however, most buyers are interested in investment rather than in building a collection. There is no solid collecting base. In light of the downward-trending art market in recent years, investors have become more conservative. The liquidity of mid-priced artworks has increased. The value and energy of classic works started to regain attention.

In the past, the preference for art inspired by Chinese culture dominated the Chinese art market. However, as the economic and cultural environment opened up, the opportunity to acquire Western art came knocking at the door of the Chinese art market. International exhibitions, as well as artworks at auction, have made it possible for Chinese buyers to consume an increasing amount of Western art.

In addition, the issue of the online art market has been enthusiastically discussed in recent years. In the future, as Chinese consumers become more and more accustomed to electronic commerce, the collaboration between the art market and e-commerce will no doubt increase.

The spillover effects of a possible bubble crisis have also drawn attention, in terms of asset allocation for individual Chinese investors and enterprises. Moreover, the prosperous private museum industry is bound to increase the influence of individual and enterprise buyers in the art market. Economic policies and government attitudes toward the art market have also had an enormous impact, as seen with the Chinese Culture and Artwork Property Exchange (CCAPE 中国文化艺术品产权交易所), China (Shanghai) Pilot Free Trade Zone (上海自贸区), and art loans, among others.

Q: What advice do you give to new collectors who are seeking to build an art portfolio?

A: Whether or not to buy an artwork is the question that most art collectors need to face. As a collector, there are four important factors that need to be considered before making a decision: authenticity, quality, availability, and liquidity.

For collectors, the issue of authenticity is at the top of the list. However, determining whether an artwork is authentic relies heavily on the experience of appraisal experts. Alternatively, collectors can check to make sure that the artwork has a complete and clear provenance. Collectors should also understand the quality of the artwork, in other words, the motif, the performance, and the technique of the piece. The quality of the individual artworks in a collection will greatly impact the quality of the collection as a whole. However, high-quality artworks with a complete provenance are always in high demand in the market, and are thus harder to come by. For example, first-tier paintings by Pablo Picasso are largely held in private or museum collections, and are not a good target, especially for new collectors. Lastly, liquidity is an important concern to bear in mind, even for new collectors, because it plays an important role when a collector’s tastes change.

The first two factors are related to a collector’s aesthetic appreciation, and the latter two are related to market insight. These four factors combined provide collectors a more objective perspective in building a collection. •